In this article, we will explore the future share price targets of Bharat Electronics Limited (BEL) for the years 2025, 2026, 2028, 2030, 2040, and 2050. Additionally, we will discuss BEL’s fundamentals, market sentiment, financial performance, and quarterly reports to assist investors in making informed decisions.

About Bharat Electronics Limited (BEL)

Bharat Electronics Limited (BEL) is a prominent public sector enterprise under the Ministry of Defence, India. Established in 1954, the company is headquartered in Bengaluru and primarily serves the aviation and defense sectors by manufacturing electronic products for the Indian Armed Forces.

BEL’s offerings include radars, communication systems, electronic warfare equipment, solar power systems, and medical equipment for civilian use. The company plays a crucial role in enhancing India’s defense capabilities by ensuring access to cutting-edge technology. BEL also exports its products to several countries and focuses heavily on innovation and research to reduce India’s dependence on foreign defense equipment.

BEL’s Fundamentals

As a Navaratna company, BEL holds a significant position in India’s defense sector. The company’s market capitalization stands at approximately ₹189,725 crore, categorizing it as a large-cap stock. With robust financial reserves of ₹15,351.41 crore, BEL is well-positioned to take on future projects and handle any challenges that may arise.

| Description | Value |

|---|---|

| Company Name | Bharat Electronics Ltd. |

| Sector | Aviation and Defence |

| Established | 1954 |

| Website | bel-india.in |

| Listing At | BSE, NSE |

| BSE Code | 500049 |

| NSE Code | BEL |

| Mkt Cap | ₹189725Cr |

| Reserves and Surplus | ₹15351.41Cr |

| ROE | 25.71% |

| ROCE | 34.6% |

| 52 Week High | ₹340.50 |

| 52 Week Low | ₹171.75 |

| P/E Ratio (TTM) | 41.80 |

| Industry P/E | 40.98 |

| P/B Ratio | 10.74 |

| Face Value | 1 |

| Book Value Per Share | ₹24.16 |

| EPS (TTM) | ₹6.21 |

| Dividend Yield | 0.85% |

| Debt to Equity | 0.00 |

| Total Revenue | ₹20938Cr |

| Revenue Growth | 16.22% |

| Net Profit (Anual) | ₹3943Cr |

| Profit Growth | 34.11% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2024 | 59.15% |

| 2023 | 84.38% |

| 2022 | 42.76% |

| 2021 | 75.04% |

| 2020 | 19.88% |

| 2019 | 13.74% |

| 2018 | -51.71% |

| 2017 | 45.72% |

| 2016 | 0.29% |

| 2015 | 40.94% |

| 2014 | 186.49% |

| 2013 | -21.33 |

| 2012 | -3.11% |

| 2011 | -23.77% |

| 2010 | -8.76% |

| 2009 | 159.15% |

| 2008 | -64.50% |

| 2007 | 56.76% |

| 2006 | 35.55% |

| 2005 | 51.14% |

| 2004 | 7.88% |

| 2003 | 252.02% |

| 2002 | 108.43% |

| 2001 | 12.16% |

BEL Share Price Target 2025

Current market sentiment around BEL is highly bullish. The expected share price target for 2025 is estimated to be between ₹225 to ₹325.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹225 | ₹325 |

BEL Share Price Target 2026

According to market analysts, BEL’s share price in 2026 is projected to range between ₹286 to ₹400.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹286 | ₹400 |

BEL Share Price Target 2028

By 2028, the share price target for BEL is anticipated to be between ₹470 to ₹570, considering the company’s steady growth and expansion in defense contracts.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹470 | ₹570 |

BEL Share Price Target 2030

Based on the company’s historical performance and ongoing projects, BEL’s share price in 2030 is expected to be between ₹680 to ₹840.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹680 | ₹840 |

BEL Share Price Target 2040

Following the long-term trend, BEL’s share price in 2040 is likely to fall between ₹1350 to ₹1800.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹1350 | ₹1800 |

BEL Share Price Target 2050

Considering the consistent growth trajectory and the company’s prominent role in defense manufacturing, BEL’s share price target for 2050 is expected to range from ₹2600 to ₹2970.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹2600 | ₹2970 |

Strengths

- Debt-Free: BEL has a zero debt-to-equity ratio, indicating financial stability.

- Strong Profit Growth: The company’s net profit grew by 34.11%, and revenue increased by 16.22% in the last fiscal year.

- High ROCE and ROE: These metrics reflect the company’s effective use of capital to generate profits.

- Consistent Operating Margins: BEL’s operating and net profit margins have been steadily increasing, showing efficient cost management.

- Government Contracts: As a defense PSU, BEL benefits from continuous government projects and contracts.

- Promoter Holding: The government holds 51.14% of BEL’s shares, while mutual funds and foreign institutions hold 15.81% and 17.27%, respectively, indicating strong investor confidence.

Risks

- Valuation Risk: The stock’s P/E ratio is slightly higher than the industry average, indicating it may be overvalued.

- Dependency on Government Contracts: The company’s revenue is heavily dependent on government orders, which can be a risk during policy changes.

- Dividend Yield: BEL’s dividend yield is relatively low, which may deter income-focused investors.

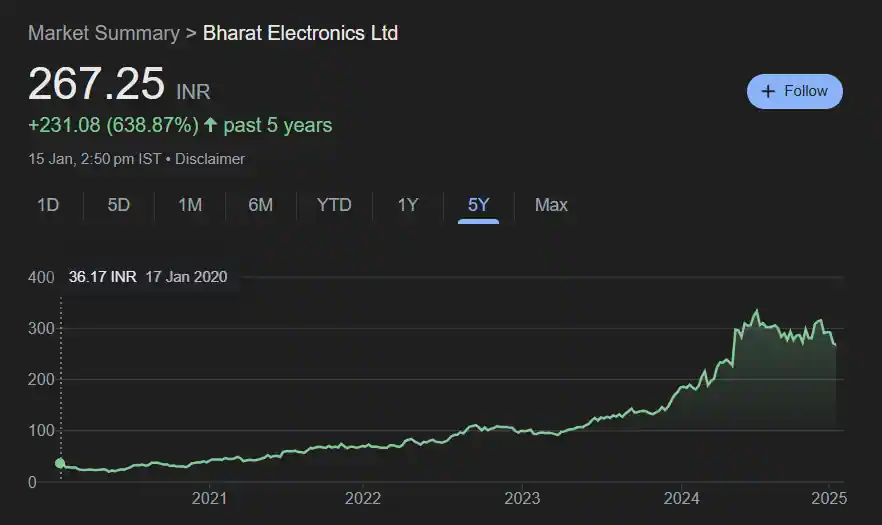

BEL Share Price History Chart

BEL Quarterly Income Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec23 |

| Revenue + | ₹4750Cr. | ₹4400Cr. | ₹8749Cr. | ₹4360Cr. |

| Expenses + | ₹3299Cr | ₹3363Cr. | ₹6363Cr. | ₹3188Cr. |

| EBITDA | ₹1555Cr | ₹1138Cr. | ₹2500Cr. | ₹1237Cr. |

| EBIT | ₹1452Cr | ₹1039Cr. | ₹2390Cr. | ₹1173Cr. |

| Net Profit | ₹1091Cr | ₹776.14Cr. | ₹1784Cr. | ₹893.30Cr. |

| Operating Profit Margin | 33.93% | 27.11% | 29.32% | 30.76% |

| Net Profit Margin | 23.81% | 18.48% | 20.91% | 21.59% |

| Earning Per Share | ₹1.49 | ₹1.06 | ₹2.44 | ₹1.22 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.70 |

BEL Annual Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹20938Cr | ₹18015Cr | ₹15600Cr | ₹14234Cr |

| Total Expenses | ₹15672Cr | ₹14092Cr | ₹12433Cr | ₹11292Cr |

| Profit/Loss | ₹3943Cr | ₹2940Cr | ₹2354Cr | ₹2069Cr |

| Net Profit Margin | 19.45% | 16.58% | 15.32% | 14.67% |

| Earning Per Share | ₹5.45 | ₹4.09 | ₹3.28 | ₹8.61 |

| EBITDA | ₹5717 | ₹4367 | ₹3572 | ₹3335 |

| EBIT | ₹5273 | ₹3938 | ₹3171 | ₹2948 |

| Operating Profit Margin | 28.23% | 24.64% | 23.27% | 23.66% |

| Dividends Per share | 2.20 | 1.80 | 4.50 | 4.00 |

BEL Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹1301Cr. | ₹3043Cr. | ₹1621Cr. | ₹759.70Cr. |

| Cash Flow From Operating Activities | ₹1267Cr | ₹4207Cr. | ₹5093Cr. | ₹2570Cr. |

| Cash Flow From Investing Activities | ₹2691Cr | ₹-4872Cr. | ₹-2595Cr. | ₹-648.96Cr. |

| Cash Flow From Financing Activities | ₹-1313Cr | ₹-1078Cr. | ₹-1076Cr. | ₹-1061Cr. |

| Closing Cash Balance | ₹3946Cr | ₹1301Cr. | ₹3043Cr. | ₹1621Cr. |

| Net Change In Cash | ₹2645 | ₹-1742 | ₹1422 | ₹860.93 |

BEL Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹225 | ₹325 |

| 2026 | ₹286 | ₹400 |

| 2028 | ₹470 | ₹570 |

| 2030 | ₹680 | ₹840 |

| 2040 | ₹1350 | ₹1800 |

| 2050 | ₹2600 | ₹2970 |

BEL Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 51.14% |

| Other Domestic Institutions | 4.40% |

| Retail and Others | 11.38% |

| Foreign Institutions | 17.27% |

| Mutual Funds | 15.81% |

| Total | 100.00% |

How to Buy BEL Shares?

Investors can purchase BEL shares through any SEBI-registered stock broker. Below are some popular online brokerage platforms:

- groww

- Zerodha

- Angel One

- upstox

BEL Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Kaynes Technology India | ₹39.80KCr. | 124.99% | ₹2424 | ₹7822 |

| Hindustan Aeronautics | ₹2.56LCr. | 22.77% | ₹2820 | ₹5674.75 |

| Boeing Co | ₹12.70 KCr. | 15.74% | ₹137.03 | ₹217.59 |

| Airbus SE | ₹12.38KCr | 6.05% | ₹124.72 | ₹172.78 |

| Bharat Dynamics | ₹42.29 KCr | 31% | ₹776.05 | ₹1794.70 |

| Apollo Micro Systems | ₹3.94 KCr. | 4.75% | ₹87.99 | ₹147.55 |

| Bharat Electronics | ₹1.97 KCr | 43.07% | ₹171.70 | ₹340.35 |

BEL Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Bharat Electronics Limited is a key player in India’s defense sector with a solid track record of growth and profitability. Its debt-free status, steady financial performance, and government backing make it a promising long-term investment. However, investors should consider the company’s high valuations and dependence on government contracts before making investment decisions.

With its focus on innovation and research, BEL is expected to remain a reliable partner in India’s defense manufacturing, making it a suitable choice for long-term investors.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as financial advice. Before making any investment, it is advisable to consult with a certified financial advisor. The author is not responsible for any investment decisions made based on this article.

FAQs

Q1. What is the BEL share price target for 2025?

Ans: The expected share price target for BEL in 2025 is between ₹225 to ₹325.

Q2. What is the BEL share price target for 2030?

Ans: BEL’s share price target for 2030 is projected to be between ₹680 to ₹840.

Q3. What is the BEL share price target for 2040?

Ans: The share price target for BEL in 2040 is expected to be between ₹1350 to ₹1800.

Q4. What is the BEL share price target for 2050?

Ans: BEL’s share price target for 2050 is likely to range between ₹2600 to ₹2970.