In this article, we will explore the future share price targets of Rama Steel for the years 2025, 2026, 2028, 2030, 2040, and 2050. Additionally, we will discuss Rama Steel’s fundamentals, market sentiment, financial performance, and quarterly reports to assist investors in making informed decisions.

About Rama Steel

Rama Steel Tubes Limited, established in 1974 by Shri Harbanslal Bansal, is a prominent manufacturer and exporter of steel tubes, pipes, and galvanized steel products in India. The company specializes in producing ERW (Electric Resistance Welded) pipes, galvanized steel pipes, and structural steel products that cater to industries such as construction, infrastructure, automotive, and agriculture.

With a focus on meeting global standards, Rama Steel has built a strong domestic and international presence, exporting to over 20 countries, including the UK, USA, Sri Lanka, Ethiopia, Kenya, Kuwait, Germany, South Africa, Congo, Guyana, and Yemen.

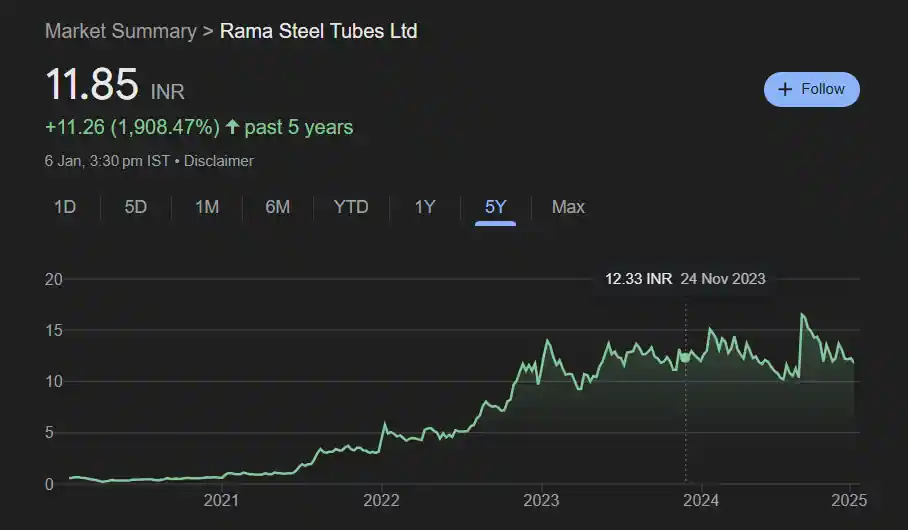

Rama Steel Price Today

Rama Steel Fundamental

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2024 | 0.33% |

| 2023 | 8.30% |

| 2022 | 145.13% |

| 2021 | 606.28% |

| 2020 | 1.59% |

| 2019 | -49.60% |

| 2020 | -56.29% |

| 2021 | 90.67% |

| 2022 | 20% |

Rama Steel Share Price Target 2025

Current market sentiment around Rama Steel is highly bullish. The expected share price target for 2025 is estimated to be between ₹8.9 to ₹13.6.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹8.9 | ₹13.6 |

Rama Steel Share Price Target 2026

According to market analysts, Rama Steel’s share price in 2026 is projected to range between ₹11.3 to ₹16.6.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹11.3 | ₹16.6 |

Rama Steel Share Price Target 2028

By 2028, the share price target for Rama Steel is anticipated to be between ₹15.8 to ₹23.5, considering the company’s steady growth and expansion in defense contracts.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹15.8 | ₹23.5 |

Rama Steel Share Price Target 2030

Based on the company’s historical performance and ongoing projects, Rama Steel’s share price in 2030 is expected to be between ₹21.4 to ₹30.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹21.4 | ₹30 |

Rama Steel Share Price Target 2040

Following the long-term trend, Rama Steel’s share price in 2040 is likely to fall between ₹38.9 to ₹55.3.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹38.9 | ₹55.3 |

Rama Steel Share Price Target 2050

Considering the consistent growth trajectory and the company’s prominent role in defense manufacturing, Rama Steel’s share price target for 2050 is expected to range from ₹56 to ₹89.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹56 | ₹89 |

Strengths

- Consistent Profit Growth: The company’s profit increased from ₹12.38 crore in 2021 to ₹30 crore in 2024, reflecting steady growth.

- Low Debt-to-Equity Ratio: A debt-to-equity ratio of 0.27 indicates low financial risk and a stable financial position.

- Strong Profitability Metrics: Return on Equity (ROE) and Return on Capital Employed (ROCE) show attractive returns for shareholders.

- Improved Cash Flow: Operating cash flow has seen growth in recent quarters.

- Promoter Confidence: Promoters hold a 47.96% stake, reflecting confidence in the company’s growth potential.

- Sectoral Demand: Operating in the automobile and ancillary sector, which is experiencing rising demand.

- Annual Profit Growth: Achieved a 9.33% growth in annual profit in the last financial year, showcasing consistent performance.

Risks

- High Valuation: The company’s P/E ratio of 72.29 is significantly above the industry average of 24.75, indicating potential overvaluation.

- Declining Revenue: Revenue growth is at -21.80%, signaling a significant drop in sales and potential operational challenges.

- No Dividend Payout: The company has no dividend payout, which might deter income-focused investors.

- Negative Cash Flow: In FY23, cash flow from operating activities was negative (-₹96.16 crore), reflecting insufficient cash generation from core operations.

- Capital Expenditures: Negative cash flow from investing activities suggests high capital spending.

- Reduced Promoter Holding: A decrease in promoters’ stake raises concerns.

- Low Margins: Operating profit margin (6.19%) and net profit margin (2.87%) are low, making the company sensitive to raw material price fluctuations and economic downturns.

- High Retail Holding: Retail investors own 51.87% of shares, potentially increasing stock price volatility.

- Profit Volatility: Quarterly net profits have shown significant fluctuations.

Rama Steel Share Price History

Rama Steel Quarterly Income Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec23 |

| Revenue + | ₹229.76Cr. | ₹159.84Cr. | ₹212.90Cr. | ₹213.48Cr. |

| Expenses + | ₹225.36Cr | ₹156.62Cr. | ₹203.71Cr. | ₹205.95Cr. |

| EBITDA | ₹6.91Cr | ₹6.33Cr. | ₹13.47Cr. | ₹13.62Cr. |

| EBIT | ₹5.81Cr | ₹4.91Cr. | ₹12.24Cr. | ₹12.50Cr. |

| Net Profit | ₹2.92Cr | ₹2.58Cr. | ₹7.29Cr. | ₹5.70Cr. |

| Operating Profit Margin | 3.15% | 4% | 6.49% | 6.45% |

| Net Profit Margin | 1.33% | 1.63% | 3.51% | 2.70% |

| Earning Per Share | ₹0.02 | ₹0.02 | ₹0.14 | ₹0.08 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Rama Steel Annual Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹1051Cr | ₹1344Cr | ₹777.37Cr | ₹476.58Cr |

| Total Expenses | ₹1014Cr | ₹1310Cr | ₹740.78Cr | ₹463.28Cr |

| Profit/Loss | ₹30Cr | ₹27.44Cr | ₹27.32Cr | ₹12.38Cr |

| Net Profit Margin | 2.87% | 2.05% | 3.56% | 2.63% |

| Earning Per Share | ₹0.54 | ₹1.10 | ₹16.41 | ₹7.21 |

| EBITDA | ₹64.42 | ₹59.90 | ₹51.11 | ₹25.87 |

| EBIT | ₹58.77 | ₹55.17 | ₹46.84 | ₹22.40 |

| Operating Profit Margin | 6.19% | 4.48% | 6.65% | 5.50% |

| Dividends Per share | 0.00 | 0.00 | 0.50 | 0.00 |

Rama Steel Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹18.71Cr. | ₹22.08Cr. | ₹13.12Cr. | ₹6.76Cr. |

| Cash Flow From Operating Activities | ₹-96.16Cr | ₹-34.98Cr. | ₹24.72Cr. | ₹29.80Cr. |

| Cash Flow From Investing Activities | ₹-53.20Cr | ₹-9.23Cr. | ₹-10.17Cr. | ₹-6.83Cr. |

| Cash Flow From Financing Activities | ₹143.26Cr | ₹40.85Cr. | ₹-5.59Cr. | ₹-16.61Cr. |

| Closing Cash Balance | ₹12.61Cr | ₹18.71Cr. | ₹22.08Cr. | ₹13.12Cr. |

| Net Change In Cash | ₹-6.10 | ₹-3.39 | ₹8.96 | ₹6.39 |

Rama Steel Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹8.9 | ₹13.6 |

| 2026 | ₹11.3 | ₹16.6 |

| 2028 | ₹15.8 | ₹23.5 |

| 2030 | ₹21.4 | ₹30 |

| 2040 | ₹38.9 | ₹55.3 |

| 2050 | ₹56 | ₹89 |

Rama Steel Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 47.96% |

| Retail and Others | 51.87% |

| Foreign Institution | 0.17% |

| Total | 100.00% |

How to Buy Rama Steel Shares?

Buying and selling of Rama Steel can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Rama Steel Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Jio Finance Services | ₹1.94 LCr. | 30.10% | ₹232 | ₹394.70 |

| Elcid Investment | ₹3742 KCr. | 5393667% | ₹3.53 | ₹332399.94 |

| Blue Chip India | ₹46.95 KCr. | 269.13% | ₹2.25 | ₹9.80 |

| LIC Housing Finance | ₹32.36KCr | 14.51% | ₹511.85 | ₹826.75 |

| Aadhar Housing Finance | ₹18.31 KCr | 29.05% | ₹292 | ₹516 |

| Can Fin Homes | ₹9.64 KCr. | -6% | ₹680 | ₹951.75 |

| Repco Home Finance | ₹2.61 KCr | 5.34% | ₹366.50 | ₹595 |

Rama Steel Share Price Target: Export Opinion

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

Rama Steel Tubes Limited is a well-established player with a strong market presence and low debt levels. However, high valuations, declining revenues, and cash flow challenges highlight notable risks.

For investors, this represents a medium-risk, long-term investment opportunity with growth potential if the company can address its revenue and profitability challenges. Caution is advised, and thorough evaluation of its financial recovery is recommended before investing.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as financial advice. Before making any investment, it is advisable to consult with a certified financial advisor. The author is not responsible for any investment decisions made based on this article.

FAQs

Q1. What is the Rama SteelI share price target for 2025?

Ans: The expected share price target for Rama Steel in 2025 is between ₹8.9 to ₹13.6.

Q2. What is the Rama Steel share price target for 2030?

Ans: Rama Steel’s share price target for 2030 is projected to be between ₹21.4 to ₹30.

Q3. What is the Rama Steel share price target for 2040?

Ans: The share price target for Rama Steel in 2040 is expected to be between ₹38.9 to ₹55.3.

Q4. What is the Rama Steel share price target for 2050?

Ans: Rama Steel’s share price target for 2050 is likely to range between ₹56 to ₹89.