In this article, we will explore the future share price targets of Scilal for the years 2025, 2026, 2028, 2030, 2040, and 2050. Additionally, we will discuss Scilal’s fundamentals, market sentiment, financial performance, and quarterly reports to assist investors in making informed decisions.

About Scilal

Shipping Corporation of India Land & Assets Limited (SCILAL) is a Schedule ‘C’ Public Sector Enterprise established by the Government of India to oversee the strategic disinvestment process of Shipping Corporation of India Limited (SCI). Incorporated on November 10, 2021, SCILAL operates from its headquarters in Mumbai, Maharashtra.

Scilal Fundamentals

| Description | Value |

|---|---|

| Company Name | Shipping Corprt of India Lnd and Ast Ltd. |

| Sector | Trading |

| Established | 2021 |

| Website | scilal.com |

| Listing At | BSE, NSE |

| NSE Code | SCILAL |

| BSE Code | 544142 |

| Mkt Cap | ₹3019Cr |

| Reserves and Surplus | ₹2755.82 Cr |

| ROE | 1.5% |

| ROCE | 1.72% |

| 52 Week High | ₹108.55 |

| 52 Week Low | ₹36 |

| P/E Ratio (TTM) | 62.32 |

| Industry P/E | 25.03 |

| P/B Ratio | 0.94 |

| Face Value | 10 |

| Book Value Per Share | ₹69.04 |

| EPS (TTM) | ₹1.04 |

| Dividend Yield | 1.02% |

| Debt to Equity | 0.00 |

| Total Revenue | ₹98.94Cr |

| Revenue Growth | 56.30% |

| Net Profit (Anual) | ₹47.49Cr |

| Profit Growth | 33.58% |

Also Read: Government defense company will give you huge profits, BEL share price target

Scilal Share Price Target 2025

Current market sentiment around Scilal is neutral. The expected share price target for 2025 is estimated to be between ₹45 to ₹120.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹45 | ₹120 |

Scilal Share Price Target 2026

According to market analysts, Scilal’s share price in 2026 is projected to range between ₹76 to ₹178.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹76 | ₹178 |

Scilal Share Price Target 2028

By 2028, the share price target for Scilal is anticipated to be between ₹160 to ₹280, considering the company’s steady growth and expansion in defense contracts.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹160 | ₹280 |

Scilal Share Price Target 2030

Based on the company’s historical performance and ongoing projects, Scilal’s share price in 2030 is expected to be between ₹260 to ₹320.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹260 | ₹320 |

Scilal Share Price Target 2040

Following the long-term trend, Scilal’s share price in 2040 is likely to fall between ₹700 to ₹860.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹700 | ₹860 |

Scilal Share Price Target 2050

Considering the consistent growth trajectory and the company’s prominent role in defense manufacturing, Scilal’s share price target for 2050 is expected to range from ₹1180 to ₹1390.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹1180 | ₹1390 |

Also Read: Suzlon share price target 2025, 2026, 2028, 2030, 2040 and 2050

Scilal Share Price Target: Export Opinion

Strengths

- Debt-Free Status: SCILAL boasts a debt-to-equity ratio of 0.00, reflecting its debt-free position and minimizing financial risks.

- Revenue and Profit Growth: Over the past year, the company has achieved significant growth, with revenue increasing by 56.30% and profit rising by 33.58%.

- Effective Capital Utilization: SCILAL efficiently utilizes its capital to generate profits, as evidenced by its improving Return on Capital Employed (ROCE).

- Strong Profit Margins: The company maintains a high net profit margin, showcasing its ability to control costs and generate revenue effectively.

- Promoter Confidence: Promoters hold 63.75% of the company’s shares, demonstrating strong management confidence in its future prospects.

- Robust Reserves: SCILAL has accumulated substantial reserves and surplus, amounting to ₹2,755.82 crore.

- Dividend Yield: Despite being a relatively new entity, the company offers a dividend yield of 1.02%, rewarding its shareholders.

- Improved ROE: SCILAL effectively uses shareholder funds to enhance its Return on Equity (ROE).

Risks

- Weak Cash Generation: The company struggles to generate cash from its core business operations.

- Declining Operating Income: While other income is growing, operating income is on a downward trend.

- Below-Average Profitability Metrics: Both ROE and ROCE are below industry averages, indicating suboptimal utilization of equity and capital.

- Declining Cash Flow: The company’s cash flow has been decreasing, raising concerns about liquidity.

- Overvaluation: SCILAL’s Price-to-Earnings (P/E) ratio is higher than the industry average, suggesting the stock may be overvalued.

- Revenue Concentration: A significant portion of the company’s revenue comes from trading activities, which can be volatile and unpredictable.

- Stagnant Quarterly Growth: Quarterly revenue growth has remained stagnant, signaling a lack of operational momentum.

- Limited Operating History: As a newly established company, SCILAL has a short track record, making it difficult to assess long-term performance.

Also Read: Tata Teleservices Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 and 2050

Scilal Quarterly Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec 23 |

| Revenue + | ₹25.40Cr. | ₹24.62Cr. | ₹24.93Cr. | ₹25.62Cr. |

| Expenses + | ₹7.80Cr | ₹8.32Cr. | ₹15.82Cr. | ₹7.51Cr. |

| EBITDA | ₹18.40Cr | ₹16.48Cr. | ₹9.28Cr. | ₹18.30Cr. |

| EBIT | ₹17.60Cr | ₹16.30Cr. | ₹9.11Cr. | ₹18.12Cr. |

| Net Profit | ₹12.86Cr | ₹11.99Cr. | ₹8.32Cr. | ₹15.14Cr. |

| Operating Profit Margin | 461.15% | 473.56% | 234.34% | 386.89% |

| Net Profit Margin | 322.31% | 344.54% | 210.10% | 320.08% |

| Earning Per Share | ₹0.28 | ₹0.26 | ₹0.18 | ₹0.33 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

Scilal Income Report

| Description | Mar 24 | Mar 23 |

|---|---|---|

| Total Revenue | ₹98.94Cr | ₹63.30Cr |

| Total Expenses | ₹43.84Cr | ₹45.72Cr |

| Profit/Loss | ₹47.49Cr | ₹35.55Cr |

| Net Profit Margin | 275.78% | 284.40% |

| Earning Per Share | 1.02₹ | ₹0.76 |

| Dividends Per share | 0.66 | 0.00 |

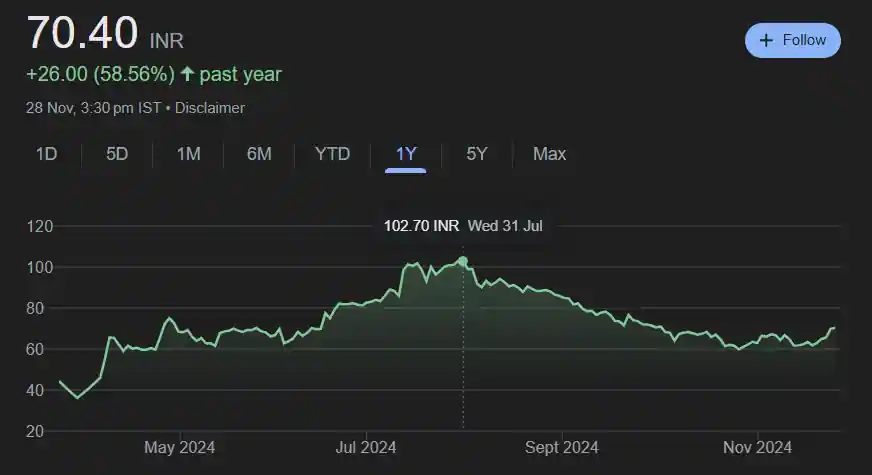

Scilal Share Price History

Scilal Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2024 | ₹30 | ₹100 |

| 2025 | ₹45 | ₹140 |

| 2026 | ₹76 | ₹178 |

| 2028 | ₹160 | ₹280 |

| 2030 | ₹260 | ₹320 |

| 2040 | ₹700 | ₹860 |

| 2050 | ₹1180 | ₹1390 |

Also Read: Ola Electric share price target 2025, 2026, 2028, 2030, 2040, and 2050

Scilal Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 63.75% |

| Other Domestic Institutions | 6.52% |

| Retail and Others | 28.19% |

| Foreign Institutions | 1.54% |

| Total | 100.00% |

How to Buy Scilal Shares?

Buying and selling of Scilal can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Godrej Properties | ₹81.35KCr. | 92.24% | ₹1495.30 | ₹3402.70 |

| Phoenix Mills | ₹60.10 KCr. | 96.89% | ₹1652.10 | ₹4137 |

| Prestige Estates Projects | ₹68.92 KCr. | 207.18% | ₹543 | ₹2074.80 |

| Oberoi Realty | ₹6502 KCr | 65.99% | ₹1051.10 | ₹1953.05 |

| Arkade Developers | ₹2470 Cr | -18.02% | ₹119 | ₹128 |

| Macrotech Developers | ₹1.24 LCr. | 78.29% | ₹641.05 | ₹1649.95 |

| IRB INFRA | ₹3032 Cr | 43.49% | ₹34.75 | ₹78.15 |

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

SCILAL has demonstrated strong financial stability, with consistent revenue and profit growth, high margins, and a debt-free balance sheet. Despite being a new entrant, it has begun paying dividends, reflecting its commitment to shareholder value. However, the company faces challenges in improving capital efficiency and addressing overvaluation concerns. Its profitability metrics, such as ROE and ROCE, remain below industry standards, and its reliance on trading revenue introduces volatility. Investors should carefully evaluate the high P/E ratio and relatively low returns on equity and capital before making investment decisions. While SCILAL shows promise, its limited operating history and operational challenges warrant cautious consideration.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as financial advice. Before making any investment, it is advisable to consult with a certified financial advisor. The author is not responsible for any investment decisions made based on this article.

Also Read:

Big company big returns Bajaj Housing Finance share price target

Ola Electric share price target 2025, 2026, 2028, 2030, 2040, and 2050

400% return in next 3 years, Exide share price target

Government defense company will give you huge profits, BEL share price target

Suzlon share price target 2025, 2026, 2028, 2030, 2040 and 2050

Tata Teleservices Share Price Target 2024, 2025, 2026, 2028, 2030, 2040 and 2050

Then don’t say that I didn’t tell you, buy NBCC shares right now.

Reliance Power share price target 2025, 2026, 2028, 2030, 2040 to 2050

Blue Chip Share Price Target 2025, 2026, 2028, 2030, 2040 And 2050

NHPC share price target 2025, 2026, 2028, 2030, 2040, and 2050

ONGC Price Target, money printing machine for small investors.

Cochin Shipyard Share Price Target 2025, 2026, 2028, 2030, 2040 and 2050

IRCTC share price target 2025, 2026, 2028, 2030, 2040 and 2050

IFCI Share Price Target 2025, 2026, 2028, 2030, 2040 and 2050

Jio Finance share price target 2025, 2026, 2028, 2030, 2040, and 2050

BEL share price target 2025, 2026, 2028, 2030, 2040 and 2050

Adani Energy Solutions share price target 2025, 2026, 2028, 2030, 2040, and 2050

Vishal Mega Mart share price target 2025, 2026, 2028, 2030, 2040 and 2050

NTPC Green Energy share price target 2025, 2026, 2028, 2030, 2040 and 2050

SJVN share price target 2025, 2026, 2028, 2030, 2040 and 2050

FAQs

Q1. What is the Scilal share price target for 2025?

Ans: The expected share price target for Scilal in 2025 is between ₹45 to ₹120.

Q2. What is the Scilal share price target for 2030?

Ans: Scilal’s share price target for 2030 is projected to be between ₹260 to ₹320.

Q3. What is the Scilal share price target for 2040?

Ans: The share price target for Scilal in 2040 is expected to be between ₹700 to ₹860.

Q4. What is the Scilal share price target for 2050?

Ans: Scilal’s share price target for 2050 is likely to range between ₹1180 to ₹1390.